Hello MCR

Is Barclays Now the Best Bank in the UK?

If you’re opening your first bank in the UK, or just looking to upgrade, there are many choices all around. However, there are really just two categories: Highstreet banks, and mobile banks.

Highstreet banks: The legacy banks with branches in town, where you can deposit cash and cheques, and discuss anything face to face.

Mobile banks: The new breed of banking that entered our lives around 2014. They’re fast, user friendly, come with more perks, and have no foreign fees.

I’ve been a big fan of mobile banks since the very beginning. In the UK, there are five banks that fit the bill: Chase, Monzo, Starling, Revolut, and First Direct. However, Revolut is not technically a bank, and First Direct is the odd one out; It launched in the 90’s as telephone banking, and is essentially the digital child of HSBC, sporting the same app with a different colour scheme.

What Do Mobile Banks Offer?

Lightening fast apps, credit on interest (Starling at 3.25%), cashback on purchases (Chase with 1% on virtually everything), everyday cashback on selected retailers (Monzo’s everyday offers are probably the best in the UK). They’re also big on security: Chase has a numberless card, Starling offers virtual cards, and Monzo keeps innovating in that space: for example, setting up safe locations where you can move money around, like your home or workplace.

And finally, they’re super useful and clear in the way they track your spending. You can categorise every transaction, exclude transfers and savings if you wish, set up budgets and more.

How Do the Big Banks Compare?

Well, most apps are way behind in terms of functionality, layout, and features.

HSBC, NatWest and Nationwide still practice extreme security theatre: card readers, telephone banking passcodes, memorable words and locations, and the list goes on. If you get anything wrong or just need a PIN reminder, you could wait over a week for it to arrive by post.

What else? Lloyds is still struggling with Apple Pay, which is shocking in 2024. Their recent app upgrade hasn’t gone well at all; months into the upgrade, the app is still split between the new and old layout and crashes on occasion. Halifax is just the old Lloyds app with a blue theme, which is probably better at this point.

Smaller players like Metro Bank, TSB, and the Co-Operative Bank are so far behind there’s really no need to comment. Just avoid.

What About Barclays?

Barclays has been improving its app and user experience year by year. With no big announcements, or logo redesigns like Lloyds, it now offers the best banking experience out of all highstreet banks.

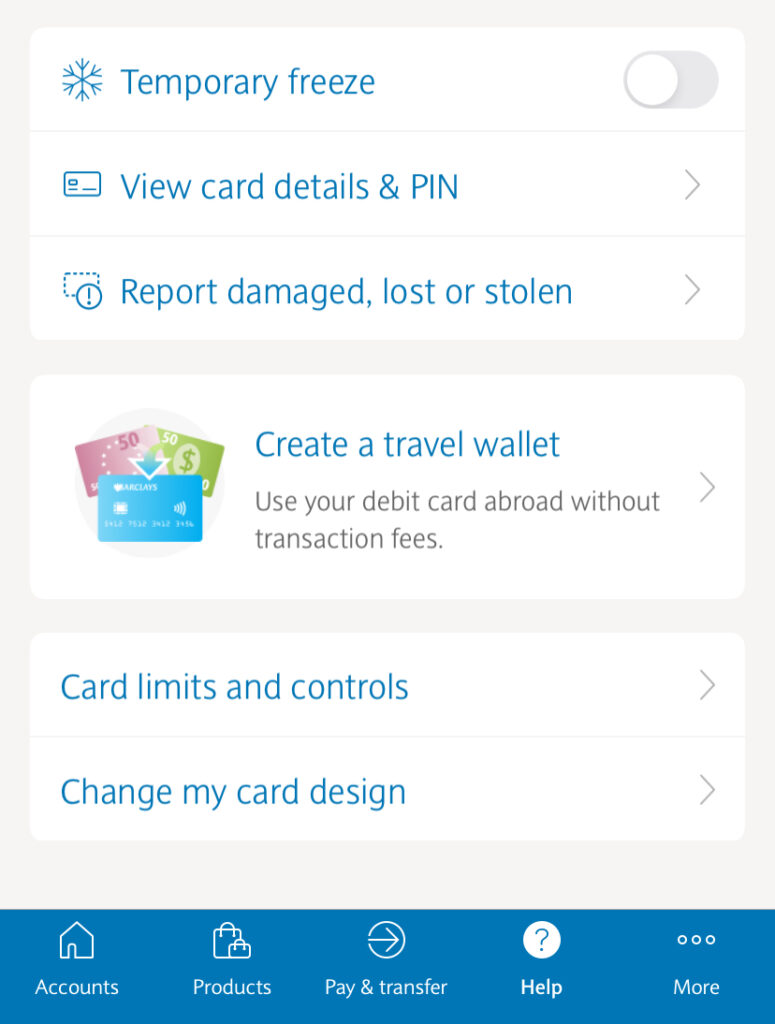

Applying for the account was a breeze, and it opens for you on the spot; You’re inside the app, with your sort code, account number, and card ready to be added to Apple or Google pay. You can view all card details inside the app. No waiting around for days to get your 4 digit PIN.

Barclays does impose some restrictions on new accounts that I quite like: it takes up to 4 days to use the PINsentry and make transfers. That seems reasonable to me. It also waits a little until it sends you your online banking code, but again, you’re good to go on the app from day one. Considering how good the app is, there’s just no reason to bank on a browser. In fact, it’s a lot less convenient. If you do find it useful, then that’s one advantage Barclays has over the mobile banks.

The Barclays App

As for the app itself, it’s a pleasure to use: it’s fast, super intuitive and packed with features. There’s always the risk of it being overwhelming, especially for a big bank that offers every product imaginable, but they’ve been able to strike the right balance. Barclays promotes its products with short blog articles, which feels more helpful than pushy (I’m thinking of Monzo and the “UPGRADE” button that never goes away).

Additionally, lots of banks nudge you towards opening savings and investments account with them. For example, Chase has a whole designated section for those. Barclays will promote all of those, but also let you be. This may be a small thing, a non-pushy bank app means less stress. We could all use less stress when it comes to money matters.

Spending

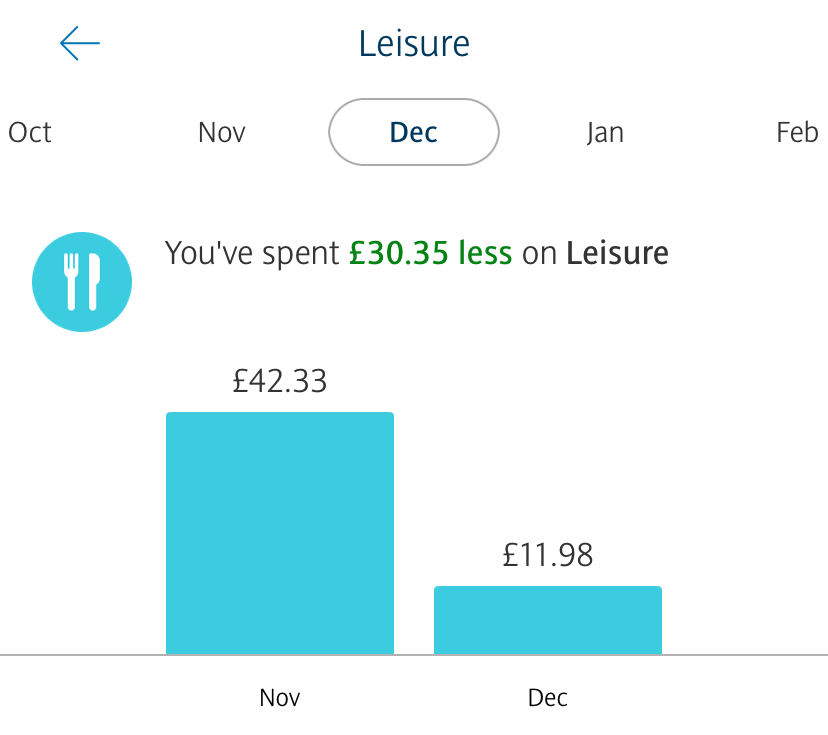

Spending and categorisation is where the Barclays app really shines. I started by noticing how much better it is compared to their highstreet competition, and didn’t realise they’re now the best. full stop.

Barclays has 12 spending categories; every transaction gets categorised, or automatically excluded from “spending”, like transfers and savings. First, it gives you a sensible overview of your spend, while also allowing to be more detail oriented with sub-categories, if that’s your thing. In addition, it compares your spend in each category with last month’s spending.

Two of the best apps in the UK are the Starling and Chase apps. And yet, Starling has so many categories it’s overwhelming and almost comical. Chase, while having the best app in many ways, doesn’t let you exclude payments from ‘spending’ and therefore gives you a distorted picture.

Regular Payment Calendar

This is a truly unique feature from Barclays: a regular payment calendar, for you to track all direct debits and standing orders. While all banks let you to manage those, having a visual representation of those payments makes a big difference. Sometimes seeing things laid out this way can make you feel more in control.

Cashback and Rewards

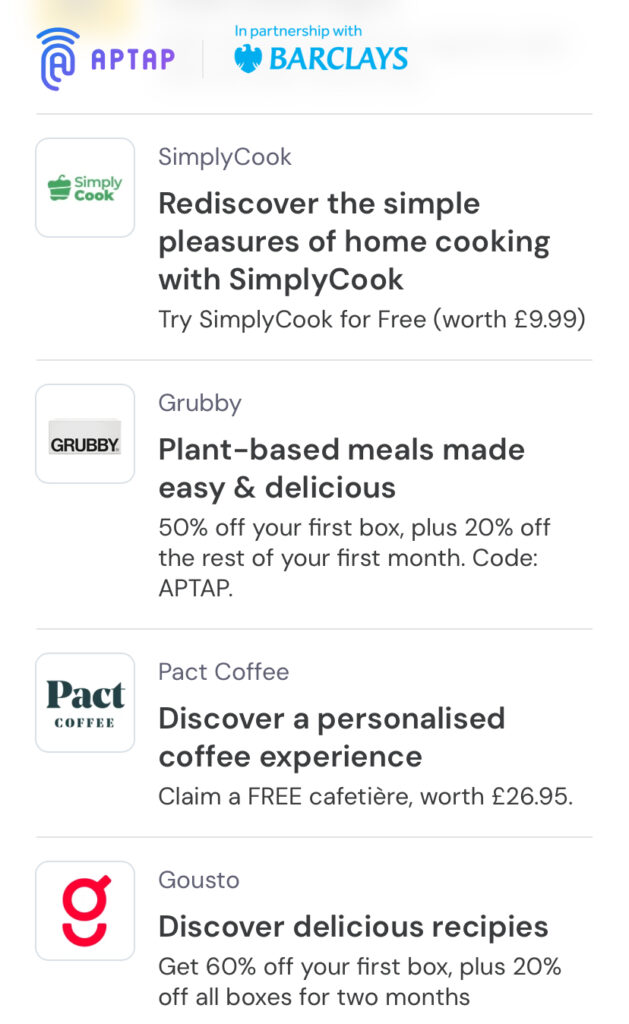

The Barclays Blue Rewards programme gives you access to Apple TV, higher rate savings accounts and a lot more. However, at £4.99 per month fee, it only makes sense if you’re committed to Apple TV. and I’m not. In contrast, Barclays’ partnership with ApTap means you have access to great everyday offers on utilities, food, fashion etc. For example, 60% off your first Gusto box, and £100 off your first case with Naked Wines. This is free for all customers.

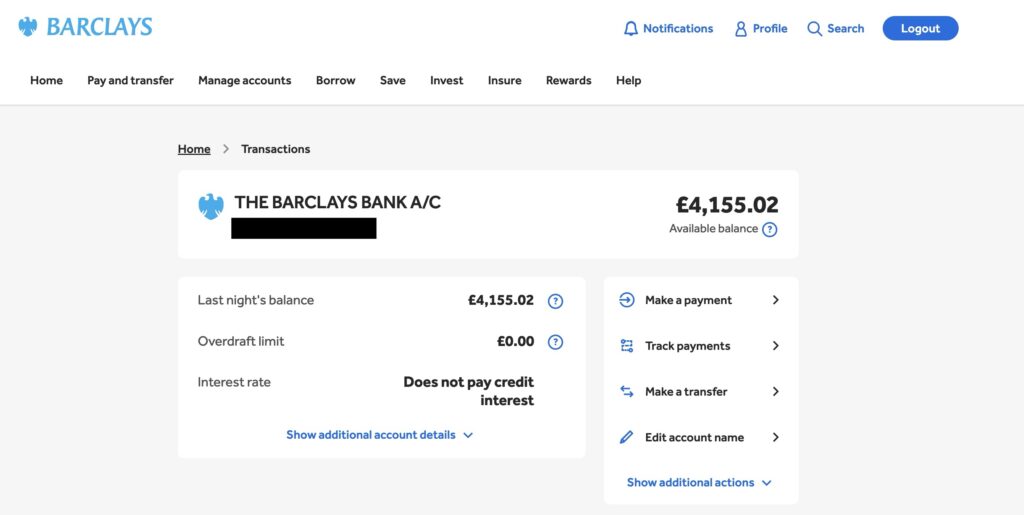

Online banking on Desktop or Tablet

This isn’t something I see myself using, as I’m generation iPhone through and through. But for those who prefer using their tablet or computer, Barclays online experience is also superior to other banks. The layout is the best I’ve seen, and remember this is one of the features that big banks have that mobile banks do not (with the exception of Starling).

Verdict

Heading into 2025, Barclays is arguably the best bank account in the UK. It’s the only highstreet bank to catch up with its Fintech competitors while maintaining all the big bank benefits. Any weaknesses? Yes, unlike the mobile banks, there are still foreign fees on the account. However, Barclays is one of the banks to offer a travel card credit card (Barclays Rewards card). Together with their current account, it’s a pretty unbeatable combination.

Visit Barclays

This is not financial advice. Please do your own research and/or consult a professional before making any financial decisions.